FTZ Academy

ITC Diligence International Inc. has more than 30 years of experience navigating the FTZ Program and processing U.S. Customs and Border Protection (CBP) forms and fees. For importers and business owners, this means they can rely on proven 4PL advice and stay focused on their business.

Resources

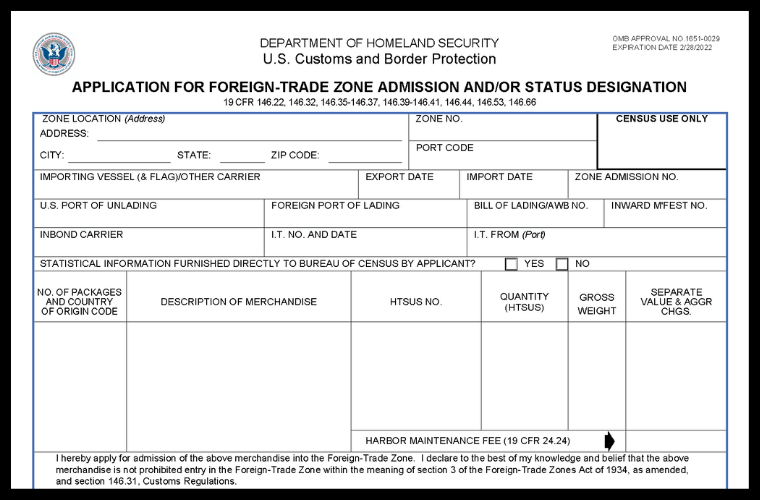

Form 214: Application for FTZ Admission/Status Designation

Looking to get goods through Customs? Form 214 is where every business starts. This form acts like an application and a permit to bring goods into a US Foreign Trade Zone warehouse. Form 214 allows businesses to get goods approved and imported into an FTZ. There are three sections that need to be filled out.

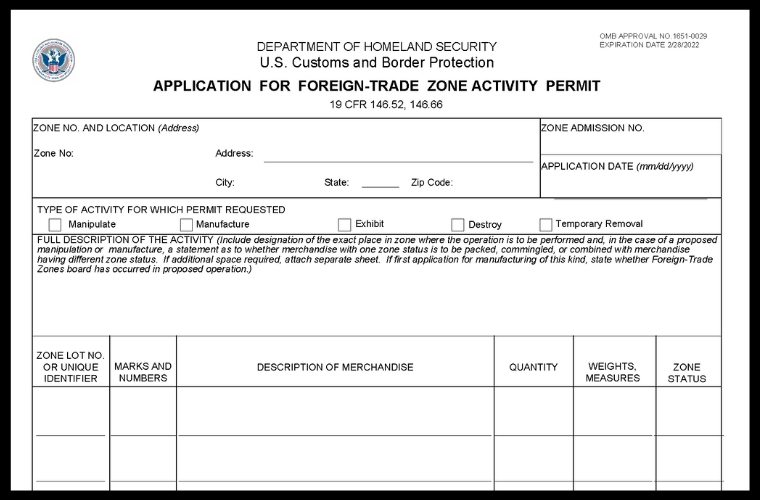

Form 216: Application for Foreign Trade Zone Activity

Importers who truly take advantage of all the benefits Foreign Trade Zones have to offer will become very comfortable using Form 216. With Form 216, a business can display products in an exhibit, relabel packages so they meet certain regulatory requirements, and even destroy goods, all while maintaining control of fees and tariffs.

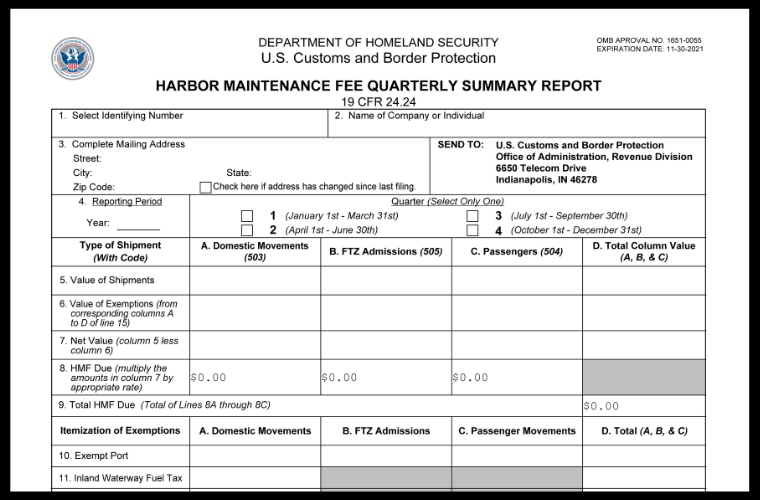

Form 349: Harbor Maintenance Fee Report

In the FTZ environment, Form 349 allows the HMF to be paid quarterly instead of upon entry, and simplifies a process that could potentially lead to bottlenecked ports. For businesses using sea ports and harbors, Form 349 gives some flexibility to how this fee (which cannot be waived or avoided) can be paid.

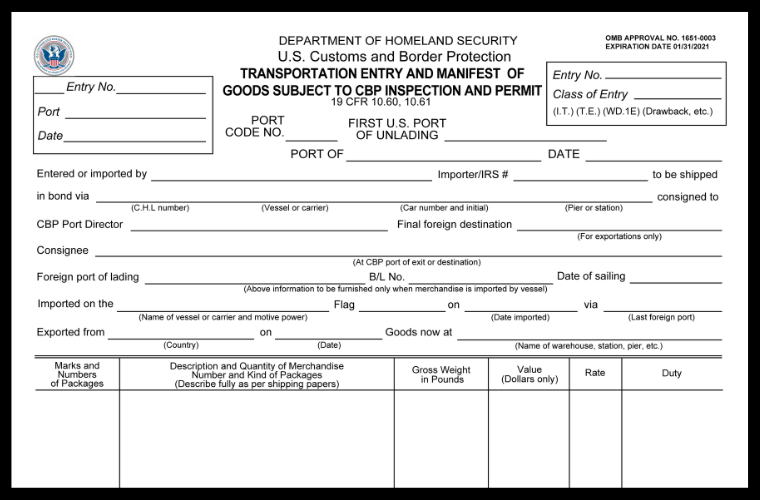

Form 7512: Transportation Entry and Manifest of Goods Subject to CBP Inspection and Permit

When goods are ready to be moved out of a Foreign Trade Zone, there are specific requirements that must be met. If any goods have been brought into an FTZ, Form 214 will accompany them. Transporting goods in bond requires Form 7512 to be completed. Form 7512 must be filled out in accordance with the following process.

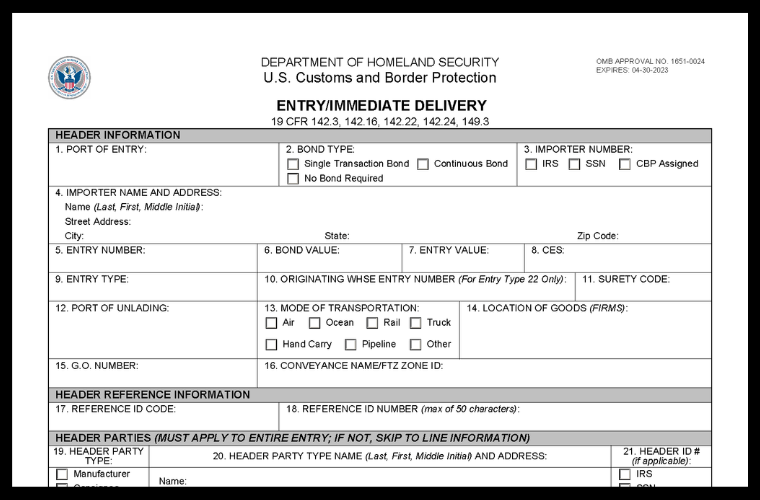

Form 3461: Entry/Immediate Delivery for Automated Commercial Environment (ACE)

Looking to get goods through Customs? Form 214 is where every business starts. This form acts like an application and a permit to bring goods into a US Foreign Trade Zone warehouse. Form 3461 is an authorization request to introduce goods into the US commerce system. Every item for sale is accounted for on Form 3461.

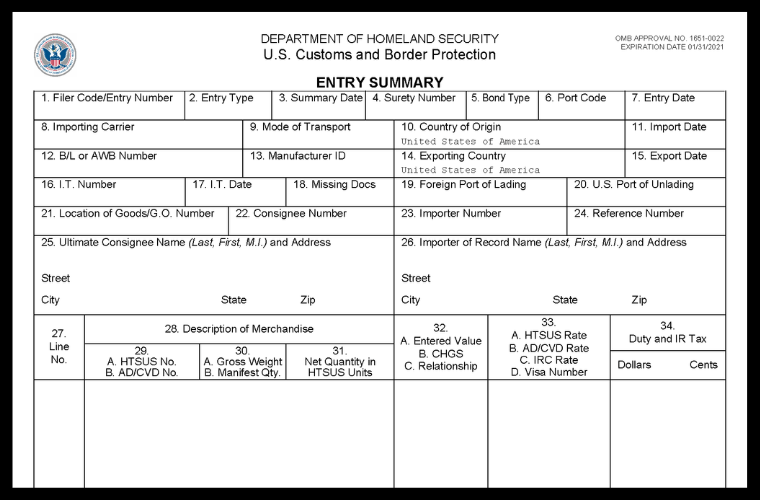

Form 7501: Entry Summary including Continuation Sheets

A full container load (FTL) or less than container load (LTL) will need an entry summary that details what is being shipped and the value amounts for the goods in the container before it can clear customs. Form 7501 adds up all the costs and fees that must be paid at the time of entry. Importers of all goods will want to take advantage of Form 7501.

Weekly Entry Program

The Weekly Entry Program through Customs is a simplified and cost-effective way for companies to import their goods into the United States. This process involves paying only one entry fee for all shipments during the week, rather than paying for each individual shipment. The process is overseen by a zone administrator, who ensures that all necessary steps are taken to comply with customs regulations.

Duty Elimination: Exporting Goods Outside the US

When you export goods outside the US, you can eliminate the fees associated with selling them domestically. This is because the goods are no longer being sold in the US, and as a result, are not subject to customs duties. ITC Diligence International Inc. can guide you through the process of exporting your goods. What are the benefits of exporting your goods?

Inverted Tariff / Manufacturing: Reduce Your Customs Duties

If your company manufactures products in the US but uses components from outside the US, you can reduce your customs duties by up to 50% by assembling the finished products in a Foreign Trade Zone (FTZ) in the US. This is known as the inverted tariff or manufacturing program. ITC can help guide you through the process and take full advantage of this program.

Duty Deferral / Cash Flow

The Duty Deferral program allows companies to defer their duty payments until their products leave the Foreign Trade Zone (FTZ). This program can provide significant cash flow benefits for companies and help improve their bottom line. What are the benefits of the Duty Deferral program?

Expedited Drawback

The Expedited Drawback program gives companies a refund on the fees they paid when they import goods into the US and later export them. This program can provide significant cost savings for companies and improve their bottom line. What are the benefits of the Expedited Drawback program?

Reconciliation Report

Every year, companies operating in a Foreign Trade Zone must file a Reconciliation Report with US Customs and Border Protection. This report is designed to ensure that all entries are complete and accurate, and that any discrepancies or errors are identified and corrected.

Foreign-Trade Zones Board Annual Report

The Foreign-Trade Zones Board Annual Report provides an overview of the activities and progress of the Foreign-Trade Zones (FTZ) program in the United States. The report provides a summary of the number of FTZs in operation, the level of employment and investment associated with these zones, and the types of goods that are handled within them.